Electronic consent

Context

The IRS requires employers to provide their employees with paper copies of W-2s at the end of the year, unless they've gotten explicit consent that their employees would prefer to receive tax paperwork electronically.

Problem

Gusto automatically creates electronic forms, but at the time we didn't have a way for employers to get consent from their employees. This means they couldn't rely on the solution we were offering because it wasn't compliant with IRS regulations (unless they were getting written consent externally). As a trusted payroll provider, our goal is to help protect customers against regulatory agencies, but we were falling short.

As a software, how might we:

- Create a way to for employers to gain consent from employees to provide forms electronically,

- Track and display who has opted in and who prefers hard copies,

- Explain this concept to employees while avoiding complex language like "consent for electronic distribution of tax form"

- (personal goal): Save trees!

Final designs

My Input

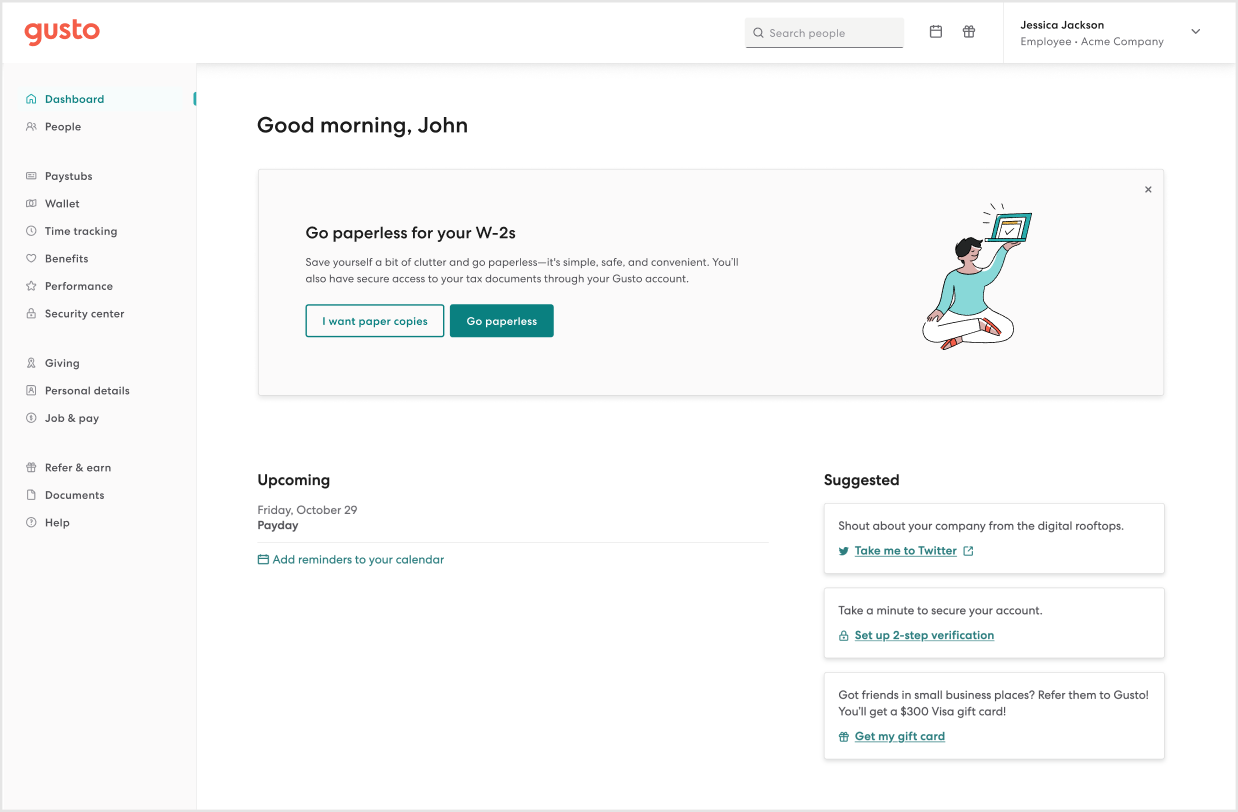

For employees: Go paperless. By reframing the solution in a way people know and understand, we can dodge the "consent" jargon and drive adoption so employers have a way to stay compliant, and employees have a way to tell their company they'd prefer less mail anyway. Win win.

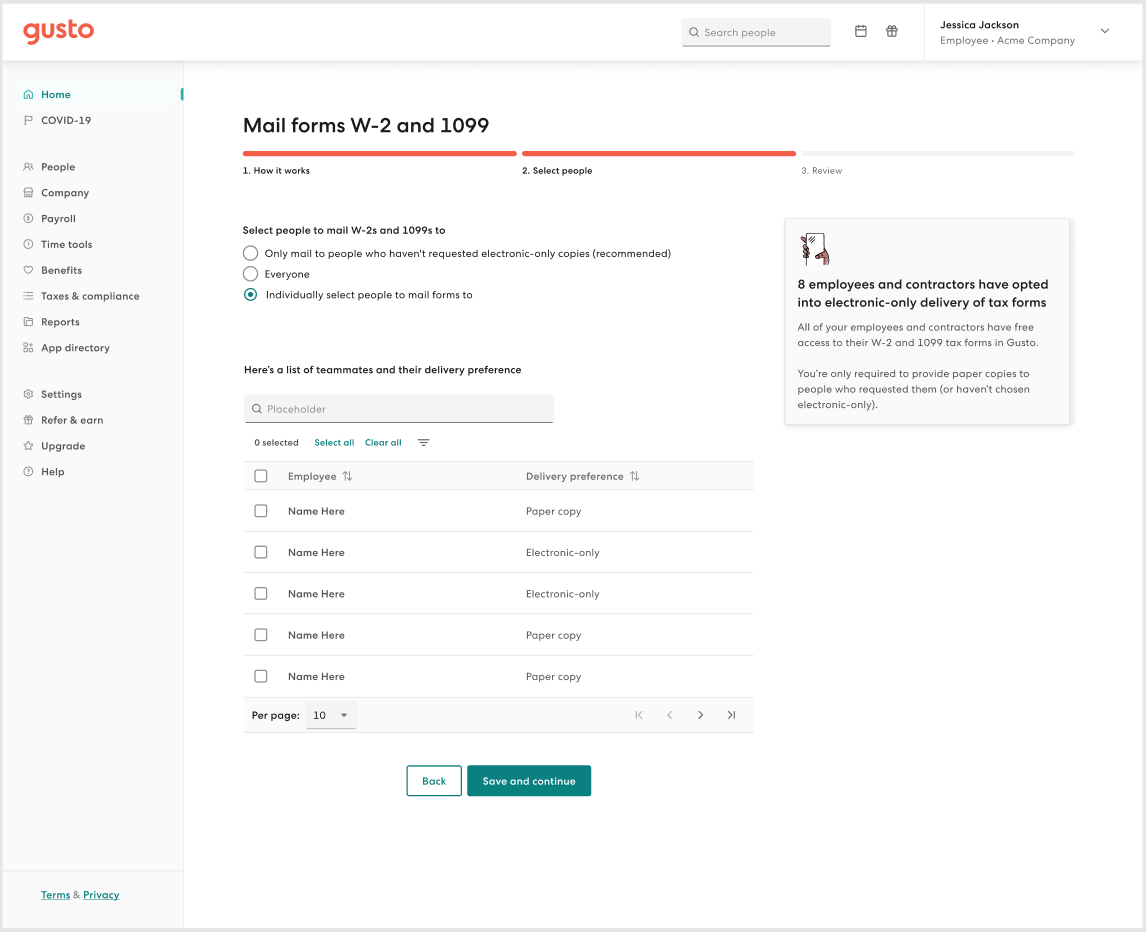

For employers: When it came time to mail tax forms, I created a way to surface who has "gone paperless" and who actually needs tax forms mailed to them. Surfacing educational compliance info in the moment (while it's relevant) increases the likelihood it'll stick. This gave customers the flexibility to decide how they want to distribute forms in a compliant way.

My role

Content designer partnered with a UX designer.

Collaborators

- Legal and compliance

- Product management

- UX Design

- Data