Taxes

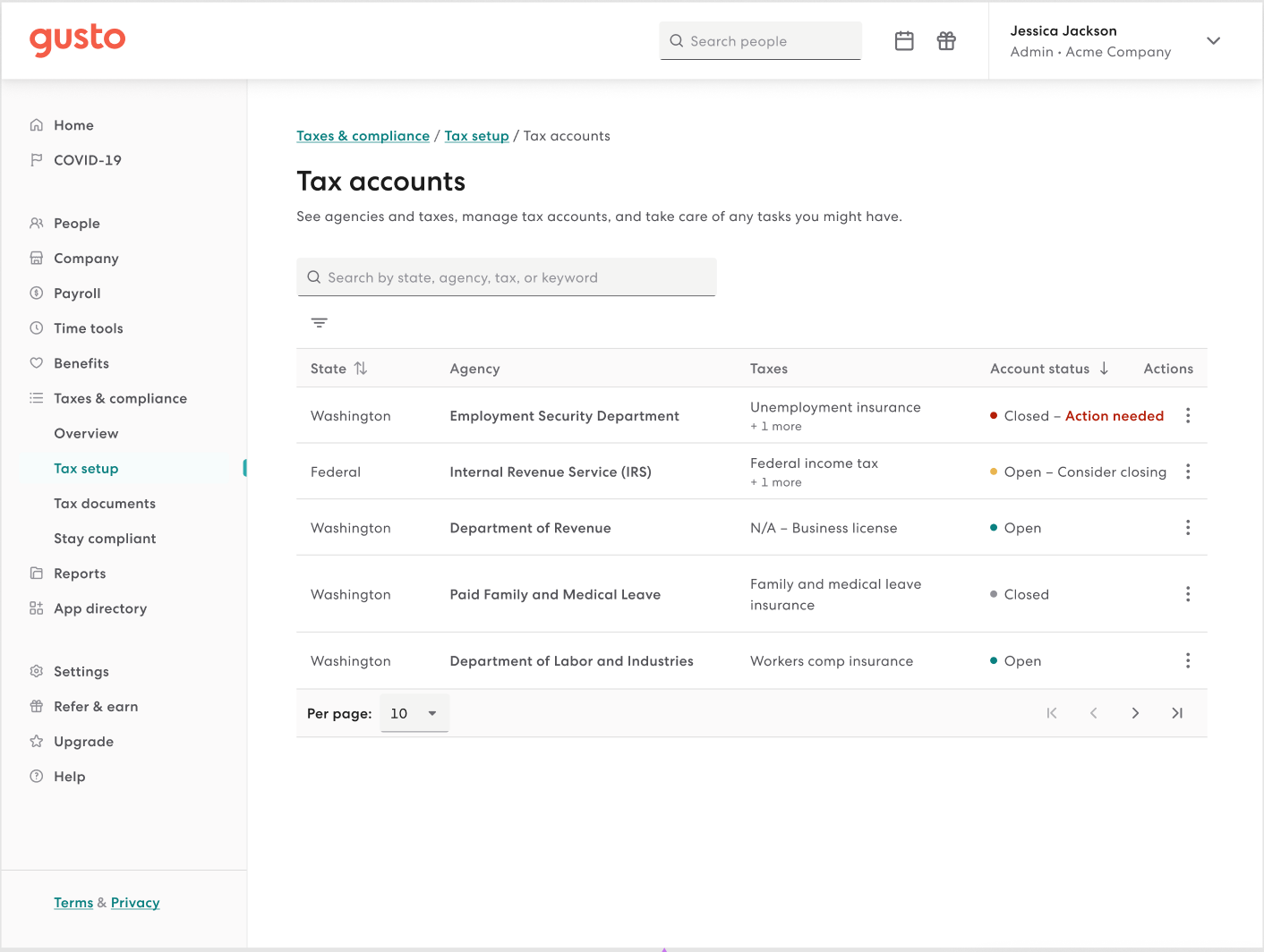

Project summary: To redesign the tax settings pages and flows so customers have a seamless way of managing their info and taking action when needed.

Problem: The existing experience wasn't built to scale. Ever since the pandemic started, companies have embraced a remote workforce, which has exponential impact on the number of city, county, and state agencies they owe taxes to. Customers couldn't find info they needed to complete basic tasks, and Gusto was having a hard time getting them to maintain their account information. When you can't find and update your tax account details, you fall out of compliance. When that happens, you get tax notices—one of the scariest moments a business owner can experience.

before

after

Solution: After considerable research and SME interviews, I chose to design a new experience from scratch, so we could deliver it quickly rather than making smaller incremental updates to the existing flows. I organized the data by tax agency, rather than by state. Tasks related to tax maintenance don't happen at the state level, and organizing it this way is a disservice to our customers and the company. By shifting focus to the agency, we can more easily and precisely alert customers of issues and actions needed. It also gives other teams across the company a place to iterate and solve other agency-level tax problems (like registering with them in the first place).